Facing unpredictable US tariffs is tough. These trade policies can squeeze your profits and disrupt your supply chain. Let's explore how to navigate this changing landscape together.

In 2025, US tariffs1 will continue pushing office chair sourcing from China to Southeast Asia. While factory costs are higher in countries like Vietnam, lower import duties often make the final landed cost more competitive for standard models, reshaping the entire import strategy for many businesses.

This shift isn't as simple as just finding a new factory. There are many factors at play, from production costs to manufacturing capabilities. As a manufacturer with over eight years of experience, I've seen these changes firsthand. Let’s dive deeper into what this really means for your business. You need to understand the full picture to make the right choice.

Why is Sourcing Shifting to Southeast Asia?

You see competitors sourcing from Vietnam or Malaysia. You worry you are paying too much by sticking with your old suppliers. Let's look at the real reasons behind this trend.

The primary driver is tariffs. US tariffs on Chinese goods make products from countries like Vietnam and Malaysia cheaper to import, even if their factory costs are higher. This trade policy creates a significant price advantage for non-Chinese manufacturing hubs, forcing many importers to reconsider their strategies.

This trend is often called the "China+1" strategy. Many US buyers want to diversify their supply chain to reduce risks associated with tariffs. They keep some production in China but move a portion to another country. What I find interesting is that many of these new factories in Southeast Asia2 are run by Chinese owners or have significant Chinese investment. They are essentially moving capital and expertise to a new location to bypass the high tariffs. This means the experience is still there, but the "Made in" label is different. For buyers, this can offer the best of both worlds: experienced management and lower import costs. The challenge, however, is that these new facilities often lack the mature local supply chain that we have in China.

| Factor | Sourcing from China | Sourcing from Southeast Asia |

|---|---|---|

| US Tariffs | High (e.g., 25%+) | Low or Zero |

| Factory Expertise | Very High & Mature | Often Chinese-led, but newer |

| Supply Chain | Highly Developed & Integrated | Still Developing |

| Geopolitical Risk | Higher for US Importers | Lower for US Importers |

Are Southeast Asian Factories Always the Cheaper Option?

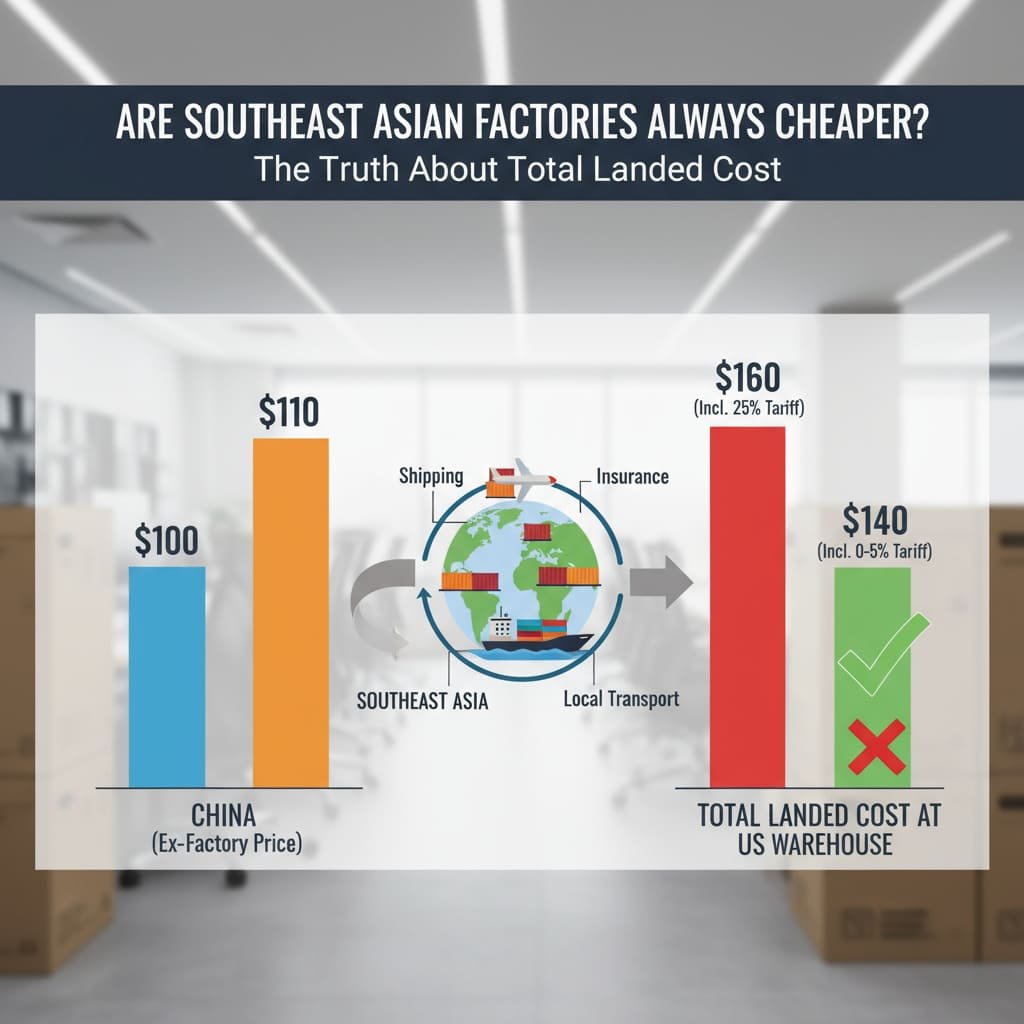

You assume moving production out of China automatically saves money. But hidden costs and supply chain issues can eat into your savings. Here is the truth about the total cost.

No, they are not always cheaper. The ex-factory price in Southeast Asia is often higher than in China. This is because of less mature supply chains and sometimes lower labor efficiency. The final cost advantage only appears after factoring in the lower US import tariffs.

We must look at the "total landed cost3," not just the factory price. The landed cost includes the product price, shipping, insurance, and import duties. This is the real cost of getting the product to your warehouse. Let's look at a simple example. I had a client who was considering moving production of a standard office chair. In China, our factory price was $50. In Vietnam, a similar factory quoted them $55 because their component costs were higher. At first, China seems cheaper. But then you add the tariffs. The 25% US tariff on the Chinese chair added $12.50. The Vietnamese chair had zero tariffs. Suddenly, the chair from Vietnam was cheaper. This tariff difference is the whole game. The higher production cost in Southeast Asia is a direct result of a less-developed ecosystem for components like casters, gas lifts, and mechanisms.

| Cost Component | Chair from China | Chair from Vietnam |

|---|---|---|

| Factory Price | $50.00 | $55.00 |

| Ocean Freight | $10.00 | $12.00 |

| US Tariff (25%) | $12.50 | $0.00 |

| Total Landed Cost | $72.50 | $67.00 |

When is Sourcing from China Still the Best Choice?

You are told to avoid sourcing from China. But for complex or innovative chairs, you cannot find quality suppliers elsewhere. You need to know when China's strengths are unbeatable.

Sourcing from China is essential for technologically advanced or highly customized office chairs. China's mature industrial ecosystem, skilled labor, and advanced manufacturing are unmatched in Southeast Asia. This makes China the only viable option for many high-end or specialized products.

For simple, high-volume chairs, Southeast Asia can be a great option because of tariffs. But what about a chair with a unique self-adjusting lumbar mechanism or a specific high-performance mesh fabric? These components are not made in Southeast Asia. They are made here in China. A factory in Vietnam would have to import these parts from China, adding cost and complexity. At Ergomakers, we work with a network of specialized suppliers who are often just a short drive away. This allows us to innovate quickly, customize products for clients, and solve technical problems efficiently. If you want to develop a new, unique product, the complete industrial chain in China is a massive advantage. Recreating this kind of ecosystem takes decades. So, for any product that requires deep engineering or a complex bill of materials, China remains the dominant, and often only, choice for serious brands.

Conclusion

The tariff situation is complex. Your best sourcing strategy depends on your specific product. You must balance factory costs against import tariffs to find the true value for your business.